This post was sponsored by our partners at Rockland Trust, but the opinions are all our own.

Members of the Boston Moms team recently had the opportunity to dive into Rockland Trust’s Ms. Money’s Classroom, a financial education learning tool for kids in grades K-5. With fun and interactive lessons on money management, Ms. Money’s classroom is the perfect primer for any parent to use! Shannon, Michelle + Ashley took some time to detail their experiences below and to explain why Ms. Money’s classroom is now our favorite resource for teaching kids about money!

Shannon, mom of 2:

“My husband and I very recently started allowing our daughter to earn an allowance. We noticed after she received gift money for her 7th birthday that she not only had an interest in money, but she really liked using her own money to buy the things she wanted! I have wished many times in adulthood that I had been taught better money management skills growing up. So much of what I have learned has been through making my own money mistakes, or unintentionally mimicking generational money mistakes I have witnessed in my own family. My husband and I knew that we wanted to do our best to teach our children this important life skill. But how?

“My husband and I very recently started allowing our daughter to earn an allowance. We noticed after she received gift money for her 7th birthday that she not only had an interest in money, but she really liked using her own money to buy the things she wanted! I have wished many times in adulthood that I had been taught better money management skills growing up. So much of what I have learned has been through making my own money mistakes, or unintentionally mimicking generational money mistakes I have witnessed in my own family. My husband and I knew that we wanted to do our best to teach our children this important life skill. But how?

As a parent who wants her child to have a solid grasp on money management, I very much recommend the Ms. Money classroom. The lessons help children understand wants versus needs, how to give with our money, and how to save. And, they are fun! After spending time with the lessons, my daughter asked if we could do more of them later. The answer was, “of course!” We both agreed that beyond the fun and important lessons, we really enjoyed the time connecting with each other. I want her to know that this is another area of her life where her dad and I will always support her. We can’t wait to spend more time together in the Ms. Money classroom!”

Michelle, mom of 5:

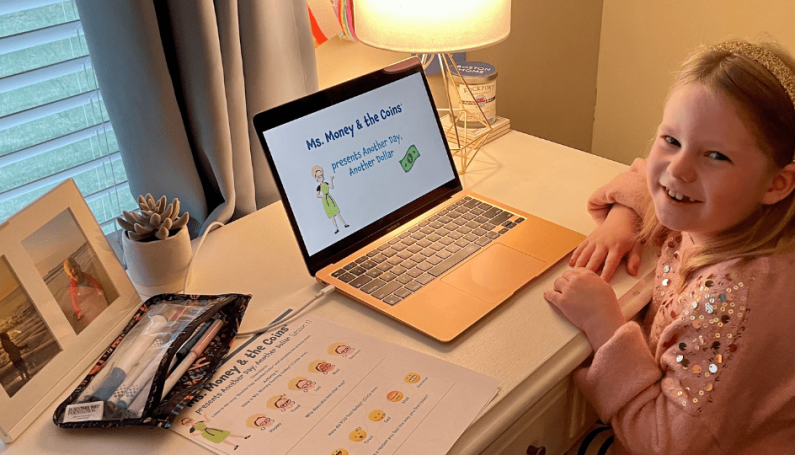

“My daughter loved working in Ms. Money’s Classroom. Through the introduction video, she became interested and excited to learn more about the best ways to use her money. The curriculum is set up in a way that you can dig a bit deeper into specific learning outcomes. There are sections about how to best use your money, why it is important to save, and even how using a portion of your money to benefit others, or share, is important. With each topic, children can listen to an audio story that follows children learning about that topic. Through this mirrored learning, children are introduced to subjects in a really attainable way. After listening to the story, many activity sheets can be found that easily download and print from your home computer.

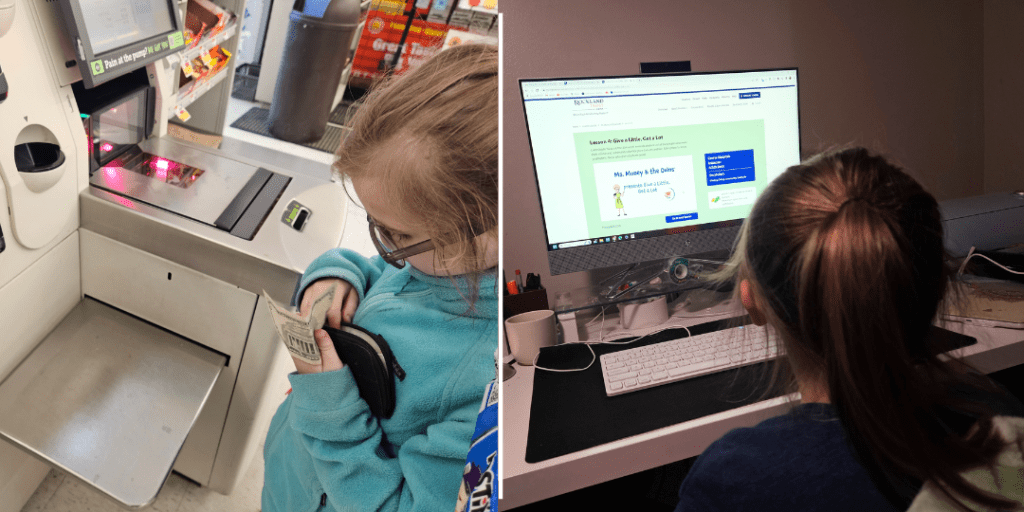

In a very visual world, it was a pleasant surprise that each topic featured an audio story, rather than a cartoon video. It made my daughter really tune in, as there were less distractions from the story. It also offered a chance for a dance party in our house, as the songs in the story are too easy to dance along with! I allowed my daughter to choose which activities she wanted to work with, and to my surprise, she wanted to complete them all. For a child who doesn’t exactly love school, she was really engaged and wanted to learn more. She even used some of the things that she learned the next time we went grocery shopping, purchasing a snack for her, and a box of macaroni and cheese to donate to the local food pantry.

Overall, Ms. Money’s Classroom is a great extension of curriculum that can be used either in an elementary classroom or at home. The content is relatable to children and gets them to think about real life scenarios. As a preschool teacher, I actually found that I can use some of Ms. Money’s curriculum in my classroom and encourage early understanding of how money works and what can be done with it. My seven year old is now working on separating her piles of ones into three groups- spend, save and give. Thanks to Ms. Money, I hope she grows to be better with money than I was at her age (or even now, honestly).”

Ashley, mom of 3:

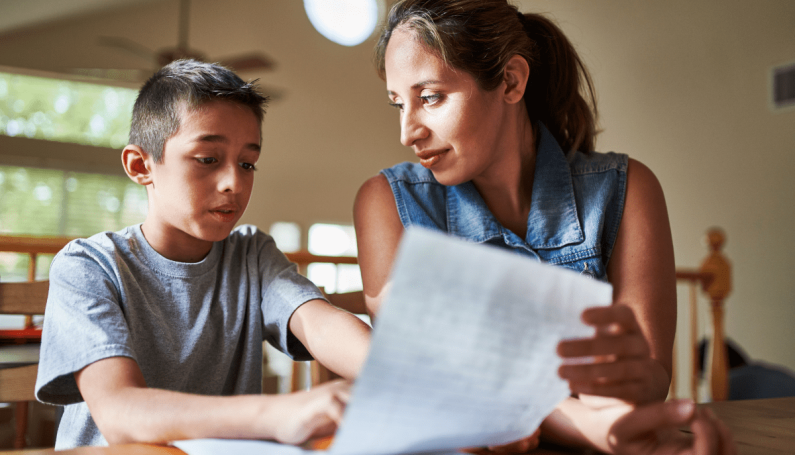

My kids are at the perfect ages to begin setting smart financial habits, but how to teach about money management has been a big question mark for me. I have one kid who is a perpetual saver, and since he spends so little he’s not super motivated to earn much. My other child would spend every penny he gets on bubble gum and Pokemon cards, and he hasn’t yet grasped the concept of saving!

Sitting down with the Ms. Money curriculum has given my kids and I some good opportunities to talk through things like needs versus wants, giving to others, and creating a plan for earning, saving, and spending. Each of the five lessons is set up with discussion questions and activity worksheets, which helped solidify my kids’ understanding of the concepts we discussed.

Teaching kids about money is not a one-time occurrence, and it will certainly take my kids some trial and error to learn how to be financially savvy. I’m glad we’ve been able to use Ms. Money as one teaching tool in our financial education journey!”